Short interest in a stock is rarely good news. It signals a lack of faith in a stock's future. And as we saw recently with GameStop (NYSE:GME), it also can lead to artificial rallies as short sellers rush to cover positions -- and sharp declines when that movement is over.

So that's why Moderna (NASDAQ:MRNA) investors probably aren't happy to see short interest in the stock on the rise since the beginning of the year. But before you imagine the worst, read on. Here's why I'm not worried about what this means for the stock now or in the future.

IMAGE SOURCE: GETTY IMAGES.

Borrowing shares now

First, a little background on short selling. Investors "short" a stock by borrowing shares now and then selling them at the market price. The investor does this with the hope the stock's price will decline before they will have to repurchase the shares to return to the original lender. A "short squeeze" happens when a heavily shorted stock starts to rise -- and those who shorted it rush to buy back shares before they lose too much money. In that case, the stock will surge -- only to fall afterward.

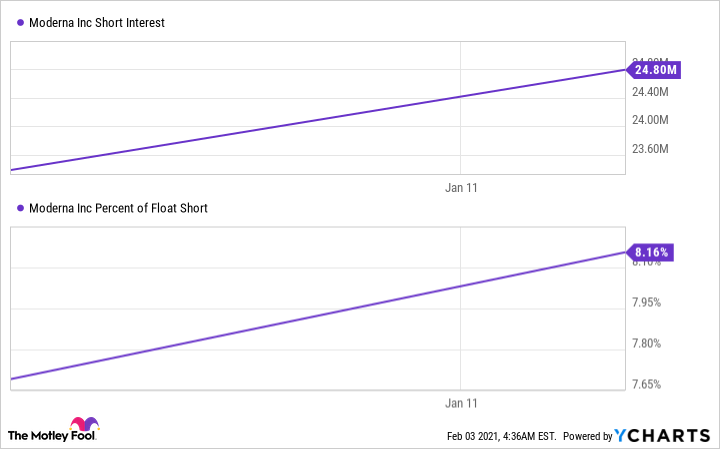

Can this happen to Moderna? Right now, a short squeeze leading to extreme movements is unlikely. Short positions have risen since the start of the year, but they only represent about 8% of Moderna's float -- or shares available for the public to trade. That means the impact would be limited if those investors rushed to buy back, or "cover," their positions.

MRNA SHORT INTEREST DATA BY YCHARTS

In the cases of GameStop and AMC Entertainment (NYSE:AMC) -- another company that experienced a short squeeze -- short positions represented a much greater percentage of the float. And that explains the dramatic swings in share price as investors rushed to cover short positions.

GME PERCENT OF FLOAT SHORT DATA BY YCHARTS

It's also important to note that Moderna's short interest was actually higher at certain points last year. Short positions reached a little more than 10% of the float in August.

So that explains the technical reason why I'm not worried about Moderna. But there is still the fact that since the start of January, more and more investors have been betting on a decline in Moderna's shares.

Can the winning streak continue?

Here's why that shouldn't be too much of a concern. Moderna recently began selling its two-dose mRNA coronavirus vaccine. The U.S. Food and Drug Administration granted it emergency use authorization in December. Last year, in anticipation of this, investors piled into the stock. As a result, Moderna gained 434% in 2020. Now, some investors wonder if the shares can continue such a winning streak -- or if the authorization of the coronavirus vaccine and the billions of dollars in revenue to come are already priced in. Those who think these factors are priced in might be shorting the stock. In fact, the stock dipped earlier this week when a Bank of America analyst downgraded the stock from neutral to underperform, citing valuation concerns. Shares have since recovered.

Whether all of that news is priced in or not, it's likely Moderna stock has farther to go. First of all, the company has new plans for its coronavirus vaccine. It's aiming to expand the indication into the 12 through 17 age group -- for a launch just before the September back-to-school period. Moderna is studying the vaccine in a phase 2/3 clinical trial for that right now.

Moderna also recently said it will explore the possibility of a third dose of vaccine as a booster. The idea is to increase immunity against new variants of the virus. And speaking of new variants, Moderna is launching preclinical and phase 1 studies of a strain-specific booster. This would target the spike protein of the South African variant. If successful, it could be adapted to other strains in the future.

Moderna also has plans beyond the coronavirus. The company is reinvesting profits from its vaccine and aims to begin phase 1 studies of preventative vaccines for HIV and the seasonal flu this year. Moderna has more than 20 candidates in the pipeline including investigational vaccines for other infectious diseases and potential treatments for autoimmune disorders and cancer. The farthest along are a possible vaccine for cytomegalovirus, two potential cancer treatments, and an investigational myocardial ischemia therapeutic -- all in phase 2 trials.

Are the short-sellers right?

In the near term, it's possible. There might be a lull in share performance as Moderna focuses on its next projects.

But Moderna offers plenty of reasons for steady share gains down the road: expanded indications for its coronavirus vaccine, boosters to improve the vaccine's performance, and the advancement of other pipeline projects. Through the coronavirus vaccine, Moderna proved that its mRNA technology works in humans. That's a huge step for its other programs since they involve the same technology.

And all of this is great news for long-term investors -- no matter what the short-sellers think.