Summary

- Berkshire lagged the S&P 500 significantly in 2020, gaining 2.4% vs. the S&P 500's total return of 18.4%.

- Berkshire's equity book gained 13.3% in Q4 to $259.6 Billion on strength from Apple and financials.

- Apple now represents half of the equity book. At a 30+ P/E, I hope Berkshire continues trimming this stake and uses the money for repurchases.

- Book value increased slightly to 1.24x in Q4 from 1.22x last quarter.

Berkshire Hathaway (BRK.A) (BRK.B) had a relatively quiet quarter. The major news from the Q3 Earnings report was the repurchase of ~45 million Class B equivalent shares for $9.3 billion, as well as a slight 4% trimming of the Apple (AAPL) stake.

I was thrilled to see Berkshire finally repurchase a meaningful amount of shares, and will be looking closely at Berkshire's repurchase activity in December when shares traded in the $220-230 range to understand Berkshire's willingness to continue repurchasing near current prices.

Q4 Holdings Update

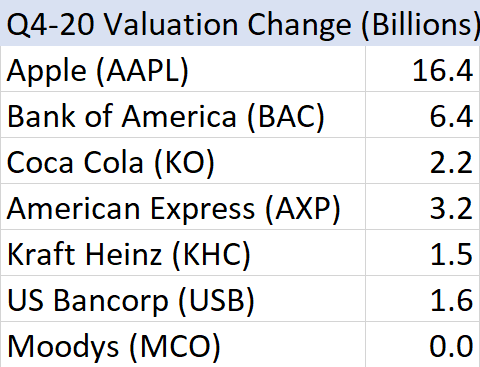

The value of Berkshire's investments in equity securities excluding Kraft Heinz (NASDAQ:KHC) rose 13.3% to $259.6 billion from ~$229 billion last quarter. The majority of the gain was from Apple, but financials were also strong.

From the ~$30.6 billion gain, after increasing the liability for future income taxes on the balance sheet as "Income taxes, principally deferred" and subtracting 21%,