Summary

- Boston Scientific Corporation has demonstrated strong growth under CEO Mike Mahoney and is projected to grow organically at the high end of its peer group.

- The stock largely overacted to the company shutting down one of its program creating a great buying opportunity.

- Procedure volumes should continue to normalize producing mid to high-single digit organic growth over the next several years.

- The stock is trading almost 1 standard deviation below its average PE multiple over the previous 3 years, while growth is expected to accelerate.

- Management just maxed out its previous buyback program, and the board just authorized another $1 billion program.

Boston Scientific Corporation (BSX) is a developer and manufacturer of medical devices. The company’s primary areas of focus are cardiovascular, vascular, digestive, pulmonary, urological, women’s health, and chronic pain conditions. BSX faced a challenging 12 years after the stock peaked in 2003 on the back of its widely successful coronary stent system. Burdened with slowing top-line growth and a tax dispute with the IRS, BSX’s stock bottomed out around $5.00 in 2013. During the previous November, having been brought in during 2011 as president from Johnson and Johnson, current CEO Mike Mahoney was appointed to turn the company around.

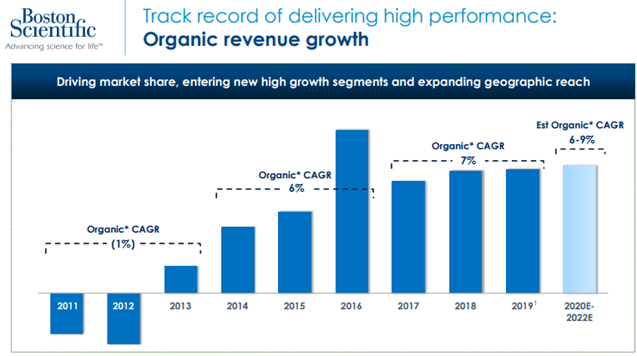

Since Mr. Mahoney took over, BSX has grown its earnings per share at a 13.3% annualized rate from FY13 to FY19. BSX’s stock price has posted 26.3% annualized returns versus the S&P up 14.83% annualized and the S&P 500 Healthcare Index up 15.46% annualized. Boston Scientific organic revenue growth profile has accelerated shifting the company from a negative to low-single digit (LSD) organic topline grower to a high-single digit (HSD) organic topline growth company. The company’s forward growth prospects are one of the highest among its peer groups.

J.P. Morgan Healthcare Conference, January 2020

Thesis:

During 2020 BSX’s stock price has faced several headwinds. The medical device industry (typically seen as a secular growth and less cyclical industry) was hit hard by deferrals of more elective procedures due to the COVID-19 pandemic. Sales dropped 20 to 30% in the 2nd quarter as people around the world were locked down. Boston Scientific’s management team, out of an abundance of caution, raised equity in May leaving technical pressure on the stock. The most recent challenge for BSX was the announcement that the company was shutting down its Lotus Edge heart valve program. The stock dropped 8.3% the day of the announcement. These challenges have resulted in sub-par performance of the stock. At the time of writing, Boston Scientific is down 22.87% YTD, while the S&P is up 17.71% and the S&P 500 Healthcare Sector is up 11.64%.

The pandemic has skewed the growth numbers and shutting down the LOTUS program has lowered the company’s growth prospects, but the story driving growth in EPS and free cash flow still remains intact. Management remains confidence that the business can grow the top-line 6 to 8% organically and expand operating margins 50 to 100bps y/y for the next couple of years (using 2019 as a base year). Based on the assumption that 2022 is a completely normalized year, it is not unreasonable for BSX to do $1.97 in EPS in 2021. A 6% to 8% topline growth rate puts BSX at the top of its peer growth in terms of growth profile which on average trade at ~23x earnings. Applying a 23x multiple to $1.97 in EPS gets you a $45.30 stock in a year representing a 29.7% return from current trading levels. Your downside is probably around $33, down ~5%.