Summary

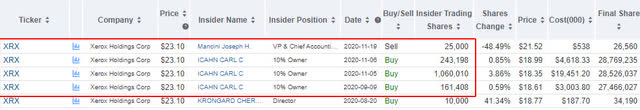

- Wall Street maven Carl Icahn, who is a 10% owner in Xerox Holdings Corporation, has been relentlessly buying the stock.

- The company has optimized its operations, reduced its expenses, and repaid a substantial part of its 2021 debt.

- The company’s cybersecurity products, cutting-edge IT solutions, and 3D metal printers that print metals are all set to score big going forward.

- I do much more than just articles at The Lead-Lag Report: Members get access to model portfolios, regular updates, a chat room, and more. Get started today »

The Renaissance took place in chaos and plague. - Shiva Ayyadurai

I had published a bullish view on Xerox Holdings Corporation (NYSE:XRX) in September 2020 when it was quoting about $18.50. The reasons that made me feel good about the stock were the insider buys by its 10% owner and Wall Street maven Carl Icahn, and because the company had started planning for a paperless future by offering proprietary IoT and AI solutions.

Well, my bullish view paid off and the stock has appreciated to $23.28 as of December 27, 2020, gaining about 26% in a space of two months.

Even today, I am bullish on XRX as a long-term investment because of the following reasons:

1. More Insider Buys

Carl Icahn is still on an XRX buying spree and that is a solid bullish signal.

Image Source: GuruFocus

In November 2020, he bought about 1.3 million shares at $23.10, and his continuing buys give a positive signal to investors. There may be something big happening under the surface that we don't know about. Whatever the story may be, Icahn's recent insider deals emit a very bullish signal.

2. Focus on Optimization and Innovation

XRX's new goals are to optimize operations, scale up revenues, and encourage innovation while focusing on generating healthy operating cash flows. This new focus is likely to help the company save $450 million in 2020, thereby shoring up its cash reserves.

Most companies are trying to survive and succeed in the post-COVID-19 era, and XRX's robotic process automation handled 1.5 million transactions in Q3 2020, a jump of 300% year over year. The company expects a similar jump in the next 18 months. Morgan Stanley predicts that 2021 will be a year of IT hardware renaissance, and it expects hardware stocks to outperform because offices are encouraging remote work and becoming flexible workplaces, thereby driving up the demand for both paper and paperless solutions.

XRX's devices have powerful in-built cybersecurity software. Its enterprise-level and yet affordably priced DocuShare Go cloud solution helps bridge the gap between office and home. On the IoT front, the company has bagged contracts with DARPA (Defense Advanced Research Projects Agency). Plus, the company signed on many new corporate clients for its IT services in Q3 2020, and its prospects are looking good.