Summary

- AstraZeneca has announced its acquiring Alexion at a fairly substantial 45% premium. It's a mixed stock - cash offer.

- The synergies will cover most of the ~$900 million in annual dividend / interest costs with significant growth potential.

- AstraZeneca is working to position itself for substantial long-term growth for shareholders.

- I do much more than just articles at The Energy Forum: Members get access to model portfolios, regular updates, a chat room, and more. Get started today »

AstraZeneca (NASDAQ: AZN) recently announced plans to acquire Alexion (NASDAQ: ALXN), a company we've discussed before here. The massive $39 billion acquisition is a 45% premium to the company's Friday closing price. It's the latest in a spate of major acquisitions like Bristol-Myers Squibb (NYSE: BMY) acquiring Celgene, discussed here, and AbbVie (NYSE: ABBV) acquiring Allergan.

AstraZeneca Overview

AstraZeneca has continued to execute incredibly well as an oncology company showing the strength of the company's portfolio.

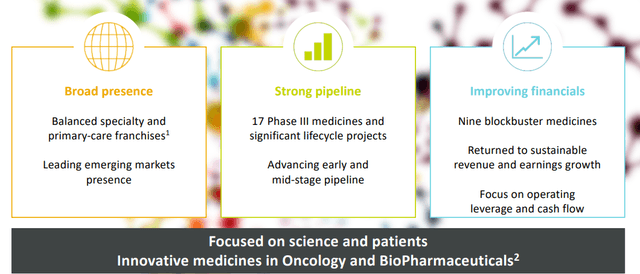

AstraZeneca Overview - AstraZeneca Investor Presentation

AstraZeneca has a broad franchise of drugs and it's building a leading emerging market presence. The company has a number of major Phase 3 medicines and it's working on its pipeline for the long run. The company is especially focused on expanding its early and mid-stage pipelines. It has a number of potential blockbuster medicines and sees sustainable growth.

The company is focused on turning this sustainable revenue and earnings growth into long-term cash flow. That cash flow will enable the company to drive substantial shareholder rewards. As a major part of the company's growth strategy, the company is focused on expanding into new segments of the market.

Alexion Overview

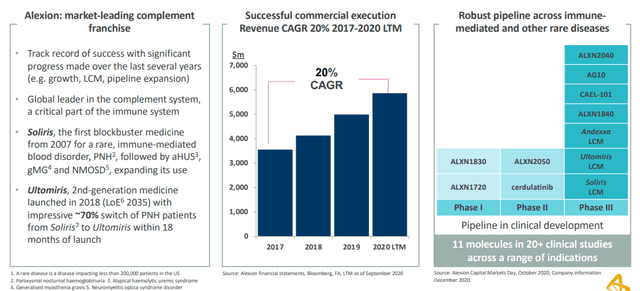

Alexion is as a mid-size pharmaceutical company that also has an exciting pipeline with significant potential.

Alexion Overview - AstraZeneca Investor Presentation

Alexion has a significant track record of progress with a significant history of revenue growth. The company has managed to grow its revenue by 20% annualized from 2017 to 2020, or from roughly $3.5 billion to nearly $6 billion. The company, on top of that revenue growth has a large pipeline of Phase 1, Phase 2, and Phase 3 assets.