Summary

- American Tower's total return overperformed the DOW average for my 60-month test period by 95.05%, which is excellent for this communications tower company.

- American Tower has increased its dividend for eight of the last ten years and presently has an average yield of 2% and has had 34 quarterly dividend increases.

- American Tower's one-year forward CAGR of 10% is good and will give you growth as the United States and worldwide population increases its use of streaming and wireless communication.

American Tower (NYSE:AMT) is a buy for the dividend growth investor and total return investor. American Tower is one of the largest providers of wireless communications services and is a growth investment that should be in all tech portfolios because of the expanding demand for 5G wireless streaming capability. The quarterly dividend was just increased to $1.21/Qtr. or a 6.1% increase, that's 34 quarterly increases in a row.

Source: AMT web site

As I have said before in previous articles,

I use a set of guidelines that I codified over the last few years to review the companies in The Good Business Portfolio (my portfolio) and other companies that I am reviewing. For a complete set of guidelines, please see my article "The Good Business Portfolio: Update to Guidelines, March 2020". These guidelines provide me with a balanced portfolio of income, defensive, total return, and growing companies that hopefully keeps me ahead of the Dow average.

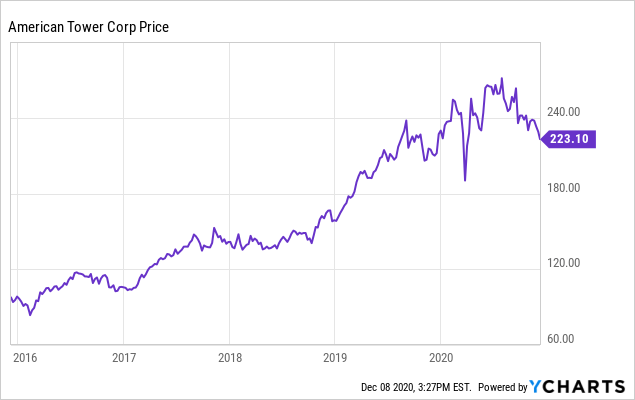

When I scanned the five-year chart, American Tower has a good chart going up and to the right in a steady, strong slope for four of the five years with a small pause in 2015 when the market was a bit negative. Recently, the AMT price has gone back to the price before the COVID-19 created a big drop. The COVID-19 correction created a buying opportunity for a great growing business at a discount price, as noted in my last report on AMT.

Data by YCharts

Data by YChartsThe method I use to compare companies is to look at the total return. If a company cannot beat the market, why do you want to invest in it? The great American Tower total return of 163.43% compared to the Dow base of 68.38% makes American Tower a good investment for the total return investor that also wants a steadily increasing income. Looking back five years, $10,000 invested five years ago would now be worth over $25,500 today. This makes American Tower a good investment for the total return investor looking back, which has future growth as the United States and foreign demand wants more of AMT's services.