Summary

- Markel has a differentiated model of investing its retained cash flows to buy other companies, similar to how Berkshire Hathaway operates.

- Its insurance business is profitable despite a challenging quarter, and the ventures segment has shown strong growth.

- Valuation metrics suggest that the shares are undervalued at the moment.

The insurance sector has yet to fully recover from the effects of the pandemic, and Markel Corp. (NYSE:MKL) is no different. Since the start of the year, Markel's share price is still down by 12%, and this compares unfavorably to the S&P 500 (SPY), which has risen by 13% over the same time frame. I believe this presents a good opportunity to own this high-quality insurance company, and in this article, I evaluate what makes Markel an attractive buy at the current valuation, so let's get started.

(Source: Company website)

A Look Into Markel

Markel is a financial holding company whose principal business markets and underwrites specialty insurance products. Markel differentiates itself from other insurance companies in the way that it allocates its capital. Unlike most insurance companies, which return most of their free cash flow to shareholders, Markel retains its free cash flow and invests it through its Markel Ventures arm. This makes Markel similar to how Berkshire Hathaway (NYSE:BRK.A) (NYSE:BRK.B) operates, in that Berkshire Hathaway also owns an array of privately-held businesses.

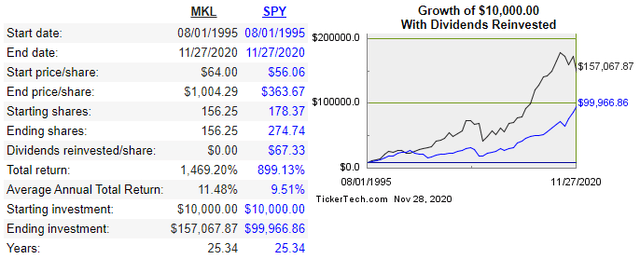

This strategy has worked well for Markel over an extended period of time, and Markel has outperformed the S&P 500 over a 25-year period. As seen below, Markel has generated an 11.5% CAGR over this time frame, outpacing the 9.5% CAGR of the S&P 500. While a couple of percentage points may not seem like much, the magic of compounding magnifies this gap over time. As such, a person who invested $10K at the beginning of this period would have $157K today, which is far more than the $100K (included reinvested dividends) that they would have with the S&P 500 (see below)

(Source: Dividend Channel)

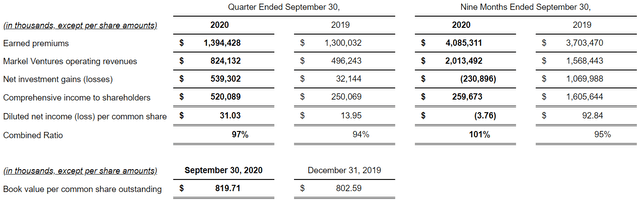

Markel delivered overall strong results in the third quarter, with earned premiums rising by 7.3% YoY, and operating revenue from Market Ventures rising by 66% YoY. These strong results led to diluted EPS more than doubling on a YoY basis, with a 122% YoY return.

(Source: Q3'20 Earnings Release)

It should be noted that catastrophe losses have taken a toll on Markel's results in the recent quarter and for the first nine months of the year. As seen above, the combined ratio, which is calculated as (incurred losses + expenses ) / earned premiums, was 97% for Q3'19, and 101% for the nine months ended Sept. 30th, 2020. This compares unfavorably to 94% and 95%, respectively, for Q3'19, and nine months ended Sept. 30th, 2019. The higher combined ratio during Q3'29 can be attributed to underwriting losses stemming from COVID-19, as well as Hurricanes Laura, Sally, and Isaias, and wildfires in the western U.S.