Summary

- As a dominant player along the pharmacy value chain, CVS has proven to be a resilient EVA generator through thick and thin.

- The company is making good progress in integrating Aetna, meaning that shareholder distributions have ample room to grow in the future.

- We believe CVS is deeply undervalued, providing one of the most compelling total return potentials in this market environment.

- Written by the FALCON Team

Introduction

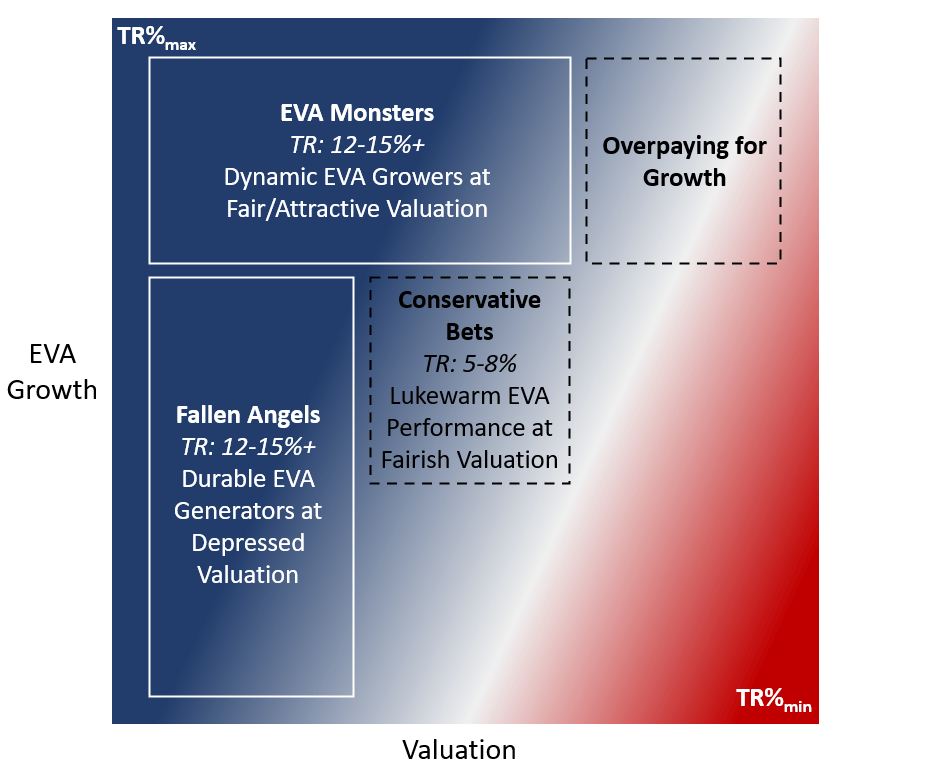

Adjacent to our initial coverage of CVS Health (CVS), we decided to readdress the company with a pronounced focus on valuation, relying on the EVA (Economic Value Added) framework. In pursuit of maximizing total returns, two segments of the stock universe are of exceptional importance, which we simply refer to as "EVA Monsters" and "Fallen Angels", as illustrated below.

Image Source: Author's Illustration

The fundamental return of every stock (excluding the effect of valuation) is composed of:

Fundamental Return = EVA CAGR + dividend yield + share count reduction

In the case of the aforementioned two categories, the composition of fundamental return is very different:

- "EVA Monsters": These are high EVA-growth companies, where the majority of our fundamental return stems from future growth in EVA. Some of these companies are major repurchasers of their shares and most pay no dividends since they have wonderful reinvestment opportunities.

- "Fallen Angels": These are mature businesses that have stable EVA generation capability but lackluster growth. Most have a sizable dividend payout, potentially enhanced by share repurchases.

While both types of investments can yield handsome results, it is readily apparent that "EVA Monsters" have a higher fundamental return than "Fallen Angels", because they possess much better growth characteristics. Why is fundamental return important? Because the longer you hold a stock, the closer your return will get to this fundamental return. In short: when our aim is to hold a stock for decades, we want "EVA Monsters" in our portfolio.

Once we laid this foundation, we can introduce valuation as the last missing piece of the equation. Let's see the full investment thesis behind both groups:

Total Return = Fundamental Return + Change in Valuation

In the case of "Fallen Angels", sentiment change is the primary source of total return. Since reversion to the mean is a one-trick pony, the sooner it happens, the higher our annualized return. The most dangerous pitfall is that this reversion takes too long to happen (if at all), dampening our total return since there is no growth to compensate for the time elapsed. A company can offset some of the "waiting time" with a handsome dividend payout, assuming the dividend is sustainable and that the EVA generation is stable. Simply put: when we buy "Fallen Angels", we want a huge discount to fair value coupled with a short holding period, hoping for a quick rebound in valuation. Until then, we collect the dividends and when the reversion takes place, we sell at fair value (the sooner, the better). In a nutshell, we don't want to be stuck holding a "Fallen Angel" for too long, unless it turns into an EVA Monster along the way (which is rather unlikely but cannot be ruled out). Monitoring these positions closely is absolutely essential since some of them may turn out to be value traps while others may transform into EVA Monsters.

When it comes to "EVA Monsters", we want to buy companies that have lots of EVA growth left in the tank, at a reasonable entry price, and hold them for the long-run. The primary pitfalls are that we either overpay for growth or that the forecasted growth does not materialize to the extent we expected. Both scenarios would sink our total return potential. Thus, we have to leave a buffer in our purchase price in case some of the EVA growth we had anticipated does not materialize, which is painful in not one but two ways: the significantly dampened fundamental return, and the corresponding change in market sentiment (that affects the valuation component of the equation), to adjust for lower future growth.