Summary

- Boston Properties misses the mark in 3Q as operating metrics come under pressure.

- Rent collections are strong, but occupancy declines are the bigger concern.

- With the office sector facing secular challenges and a long way off a full recovery, I see more risk than reward in Boston Properties.

Boston Properties (BXP) has a lot going for it – not only does the company hold a best-in-class office portfolio, but it also has a strong management team at the helm. Though BXP remains the benchmark, I am not bullish just yet. Despite yesterday's vaccine announcement boosting the stock, I still think the range of headwinds at play, from BXP's exposure to COVID-impacted areas like retail and hotels, as well as the secular work-from-home shift, threatens the long-term earnings power. At current valuations, I see more risk than reward in BXP.

FFO Misses the Mark as Operating Metrics Come Under Pressure

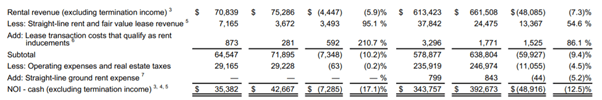

BXP reported a 3Q20 FFO/share of $1.57, slightly below consensus and down 4.3% YoY. That said, excluding a ~$0.06/share write-off from accrued rent and accounts receivable (primarily related to tenants in COVID-affected industries), FFO would have been in-line. But same-store NOI trends are also under pressure, down ~8.5% YoY on a GAAP basis and 13.1% YoY on a cash basis (-12.5% YoY reported), on a ~90bps occupancy decline to 91.1%. Much of the NOI weakness was again, down to COVID-impacted areas – the reported cash same-store NOI growth of -12.5% YoY moves to -8.1% YoY excluding deferrals and -2.7% YoY adjusted for parking and hotel revenue losses.

Source: 3Q20 Supplemental

While operating metrics remain pressured given the COVID impact, lease spreads were up ~13.7%, a positive surprise on decent volume. As of 3Q, rent spreads on second-generation space were +20.1%, with spreads strongest in San Francisco (+29.5%), followed by Los Angeles (+19.6%), and Boston (+15.3%), with DC the laggard (+1.06%). With no guidance provided, though, it's hard to make a call on office fundamentals being anywhere near the bottom at this juncture.