Summary

- IRM continues to go through a transformation as the company focuses on growing their data center division.

- The relationships built from the storage division allows for cross-selling of other offerings like data centers.

- 5 of the top 10 cloud providers are IRM data center customers.

- Looking for more investing ideas like this one? Get them exclusively at High Yield Landlord. Get started today »

For years, many have recognized Iron Mountain (IRM) as merely a records storage company. However, the company has been going through a transformation to add much more property type offerings that have not yet caught on with investors. We have seen this story play out in other industries where a company goes through a transformation and does not get its rightful valuation until the transformation is closer to completion.

Safe record storage continues to be a focus for the company, and one in which they have built tons of business relationships. These business relationships will be huge as the company cross sells the other offerings they have, which I will discuss in more detail below.

Here we are now in the seventh month since the pandemic crash in March, and many REITs have yet to recover. Year-to date, shares of IRM are down roughly 15%, which is in line with the greater real estate industry as the Vanguard Real Estate ETF (VNQ) is also down 15% on the year. Since the March 23rd lows, IRM has gained 22%, but I believe the stock can move much higher moving forward.

The transition I speak of is the company building a presence in the data center space, and that has me excited. Data centers are a growing trend around the world as more and more companies make the move to the cloud and digitize their business. Data centers continue to be a major growth story for the company and I believe they are still only in the early innings.

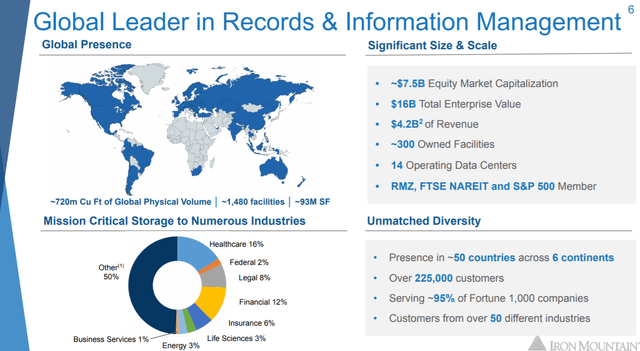

Source: Q3 2020 Investor Presentation

Looking at the snapshot above, you can now see that the company has 14 operating data centers. The company had a global presence across all industries.

As I mentioned, data centers are still in the early innings for the company as they account for less than 10% at the moment. Records management, which has been the core of the business for years, accounts for 72% of the company’s $4.2 billion in revenues.