Summary

- Earnings will likely continue to recover in the coming quarters due to a sequential decline in provision expense.

- CFG’s TOP 6 program will likely limit the growth of non-interest expenses.

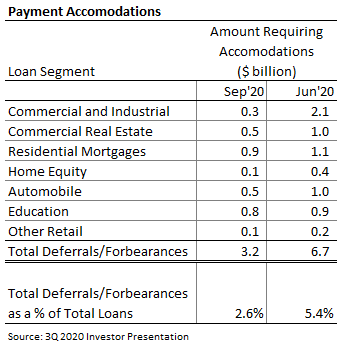

- Only 2.6% of total loans required payment deferrals or forbearance by the end of the last quarter, which shows that the credit risk is low.

- The target price for the mid of next year shows a high upside, which warrants a bullish rating.

Earnings of Citizens Financial Group, Inc. (NYSE: CFG) continued to improve in the third quarter due to a further decline in provision expense and heightened mortgage banking revenue. Earnings will likely recover further in the coming quarters because the provision expense will likely continue to decline. CFG’s aggressive loan loss reserve build earlier this year will likely cover credit losses in the coming quarters, which will lead to a decline in the provision expense. Further, the management’s initiatives will likely control the growth of non-interest-based expenses in the coming quarters. Overall, I’m expecting CFG to report earnings of $2.02 per share in 2020 and $3.11 per share in 2021. CFG’s credit risk has significantly declined in the third quarter with only 2.6% of total loans requiring payment modifications by the end of September 2020. The June 2021 target price suggests a high upside from the current market price; therefore, I’m adopting a bullish rating on CFG.

Small Amount of Loans Requiring Payment Relief Shows that Credit Risk is Low

CFG is currently facing a very low level of risk because loans requiring payment accommodations made up just 2.6% of total loans at the end of the last quarter, down from 5.4% at the end of June, according to details given in the third quarter’s investor presentation. I’m expecting the proportion of modified loans in the total loan portfolio to decline even further as the economy gradually picks up. Only the hotel and travel industries are likely to require payment relief through at least the mid of 2020 due to demand disruption amid the COVID-19 pandemic. Fortunately, the accommodation and food services industries made up just 3.4% of total loans, and retail and hospitality real estate made up 2.0% of total loans at the end of the last quarter, according to details given in the presentation. The following table shows the changes in the modified loan amounts by loan segments over the last quarter.

Although low, the credit risks are not completely absent at this point. COVID-19 sensitive commercial loans, including accommodation, retail trade, and energy, made up 10.6% of total loans at the end of the last quarter, as mentioned in the presentation. Further, CFG had significant exposure to some consumer loans, whose asset quality is sensitive to delays in the government’s stimulus checks. Judging by the latest news reports, an agreement on the stimulus appears unlikely before the elections. The following table shows CFG’s exposure to loan segments that I believe pose some credit risks.