Summary

- IRM is in a high-margin, high cash flow business. It carries a dividend yield of 9%.

- Despite the impact of COVID-19, cash flow remains very strong and growing.

- AFFO is rising, and dividend coverage is improving. A dividend increase is more likely than a cut.

- Buy IRM before the market wakes up and smells the cash flow.

- Looking for a portfolio of ideas like this one? Members of High Dividend Opportunities get exclusive access to our model portfolio. Get started today »

- Co-produced with Beyond Saving

At High Dividend Opportunities, one of the things we look for is situations where the fundamentals of a company are strong and improving, while the share price is depressed. After all, dividend yield is impacted by two factors. The amount the company pays out and the trading price of the shares.

Today, we are taking a look at a company that the market has been very skeptical of. This company has increased its dividend every year for the past 10 years. The impact of COVID-19 has been minor, the dividend is covered, and the company has been taking advantage of current low interest rates to refinance a substantial portion of its long-term debt.

Despite all of this, investors can get a current yield of 9%, enjoying a high level of current income and excellent prospects for future price growth.

Iron Mountain (IRM) is an investment we have discussed before and is an excellent opportunity for investors looking for solid cash flow. IRM's business can be broken into three categories:

- Storage

- Service

- Data Centers

Business #1: Storage

Corporations produce paperwork, they produce literally tons of paperwork. While most of it is not used on a daily basis, corporations need to retain paperwork for various practical and legal reasons. This paperwork needs to be stored somewhere where it's out of the way, but still needs to be accessible when it's needed.

This is where IRM stepped in, providing its customers with physical storage space, while also taking on the obligation of tracking and transporting when a customer needs a particular record, as well as securing sensitive documents.

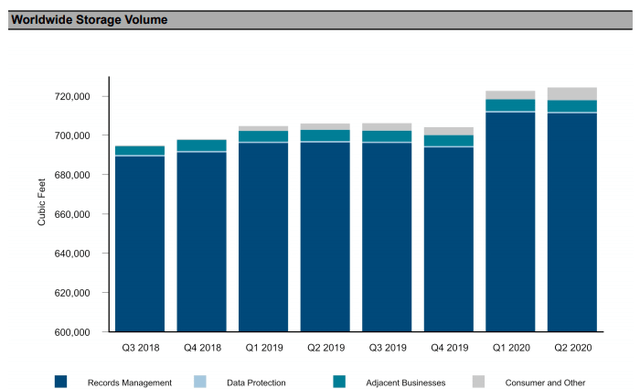

IRM has become the clear leader in this sector in the US and has developed a significant international presence as well, having spent the past few decades buying up their smaller competition and growing their storage volume.

Source: IRM Supplement

We live in an increasingly digital world, and most of us can imagine a world where virtually all records are created electronically, maintained electronically, and are never printed on paper. Many of us already work in businesses that have achieved that.