- Eastern Bankshares has floated its common stock as the firm transitions from a mutual holding company to a stock form of ownership.

- The company is a 200 year old community banking concern in the Northeast U.S.

- While there have been several community bank IPOs in recent years, performance has been lackluster as banks have been pressured with ultra low interest rates.

- Looking for more investing ideas like this one? Get them exclusively at IPO Edge. Get started today »

Quick Take

Eastern Bankshares (EBC) has filed to raise $1.8 billion in an IPO of its common stock, according to an S-1 registration statement.

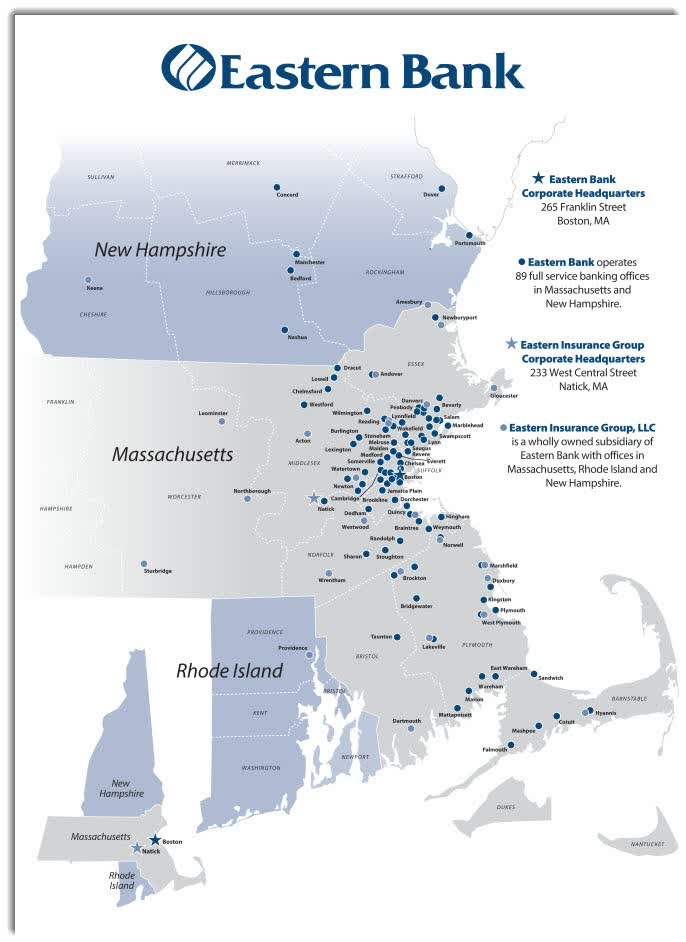

The firm operates a network of community bank branches in the Northeast U.S.

EBC is operating in an extremely low interest rate environment, putting downward pressure on profits for the foreseeable future, so I've passed on the IPO and I'm avoiding the stock going forward.

Company & Technology

Boston, Massachusetts-based Eastern was founded over 200 years ago as a local savings bank and expanded to provide community banking and insurance services to individuals and businesses in Massachusetts, New Hampshire and Rhode Island.The firm has expanded its branch network according to the map below:

Management is headed by Chairman and CEO Robert Rivers, who has been with the firm since 2006 and was previously an EVP for Retail Banking at the former Commercial Federal Bank in Omaha, Nebraska.