Summary

- Bristol-Myers Squibb reported 2Q20 a few days ago, and the results were excellent. The forecasted Celgene effects are starting to materialize as integration moves forward.

- The quarter saw continued inventory workdown, several new medications in the pipeline moving forward, and several launches as well.

- Guidance is increased, the company continues to hold an excellent, strong balance sheet and has the financial flex to do what it needs in terms of capital allocation.

- Guided-for synergy effects of $2.5B seem not to have been exaggerated, and are on track.

I wrote about Bristol-Myers Squibb (BMY) in my article in May, where I declared it a corona discount. Since that time, valuation has (thankfully) not moved that much, enabling us to still invest in this excellent company at an appealing valuation.

This giant in cardiovascular diseases, immunosciences, virology, and oncology has not convinced the market yet, and while we can of course see continued challenges (also highlighted in the quarterly), the overall positive picture on BMY remains - and I consider it one of the two best healthcare/pharma investments you can make at this time.

Let me show you why that still is the case.

Bristol-Myers Squibb - How has the company been doing?

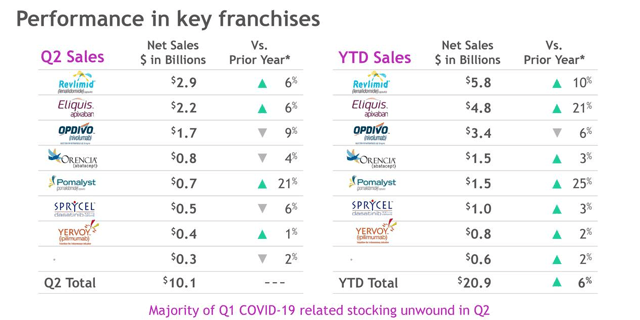

First off, the core of the company's results. Here we usually look at company core product sales during 2Q20, and during the year thus far. While healthcare companies as a whole have experienced multiple expansion, this hasn't really been the case for BMY following strong quarters, despite numbers such as this.

(Source: BMY 2Q20 Presentation)

(Source: BMY 2Q20 Presentation)

While there are drops in some segments, most of these are quarterly, not in terms of the full year.