Brookside Mezzanine Partners is pleased to announce its recent investment activity. Our relationship focus, longevity, and partnership approach makes us an ideal financing partner during both great economic times and times of uncertainty. We welcome investment proposals and promise a prompt and confidential response.

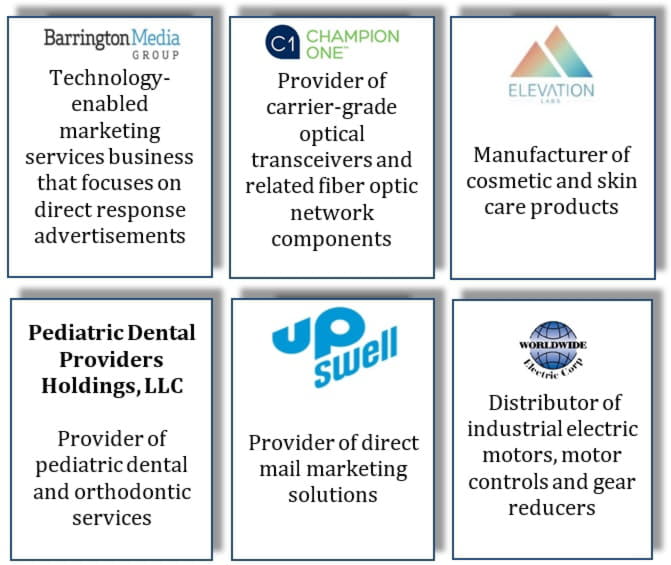

New Platform and Add-on Investments

Realized Investments

Below are additional highlights of the first six months of 2020:

Opened a West Coast Office in Los Angeles, CA

The Los Angeles office was opened and is being led by Principal, Nicholas Ganias. The decision to expand our presence and create an office in the region was a logical next step in our growth strategy and allows us to better serve the many relationships we have with the private equity, investment banking and lender communities in the area. Nick Ganias can be reached at (213) 634-5988 or nganias@brooksidemp.com.

Hired Alfred Minahan as Senior Associate

Alfred Minahan joined the Firm as Senior Associate after previously being a Senior Associate at JMC Capital Partners, a private equity firm based in Boston, where he focused on the industrial product and technology sectors. Prior to JMC, Al worked for Alcentra Capital Corporation’s direct lending platform, as well as Jefferies LLC’s leveraged finance group. Al began his career as an Audit Associate in the banking and capital markets group at Ernst & Young. Al holds a Bachelor of Science Degree from Boston College, Carroll School of Management, with a double concentration in Finance and Accounting.

Investment Criteria:

- EBITDA greater than $3 million

- Revenue greater than $15 million

- EBITDA margins greater than 10%

- Defensible market position

- Stable financial performance

Preferred Sectors:

- Niche Manufacturing

- Specialty Distribution

- Business Services

- Transportation / Logistics

- Healthcare Services

- Consumer Packaged Goods

About Brookside Mezzanine Partners

Founded in 2001, Brookside Mezzanine Partners has raised $900 million across four funds. The Firm is a leading provider of junior capital, typically in the form of subordinated debt, unitranche loans, second lien loans and minority equity capital, to small and mid-sized companies throughout the United States. We invest in both sponsored and non-sponsored transactions and provide capital to support buyouts, leveraged recapitalizations, strategic acquisitions, dividends and growth capital.