- Berkshire has underperformed the market over the last few years, but this could be about to change.

- Higher rates and inflation, which could materialize in a few years, will be great news for Berkshire.

- Technical analysis aligns with fundamentals, pointing to short-term pain and long-term gain.

Thesis Summary

Berkshire Hathaway Inc (BRK.B) is a diversified conglomerate with many revenue streams and defensive nature. For this reason, I believe the company will thrive under the higher rate and inflation environment we could experience in the next few years. Technical analysis supports the thesis that one should buy the dip and hold for the long-term.

Source: Huffpost.com

Berkshire will thrive in a recession

In my last article on Berkshire Hathaway, I talked about how Berkshire would be well-positioned if we face economic weakness. Today I would like to elaborate on that point and explain why Berkshire is perhaps the best recession hedge out there. Its balance sheet, investment style, and the other revenue sources which make up the Berkshire conglomerate will ensure that the company delivers value no matter what.

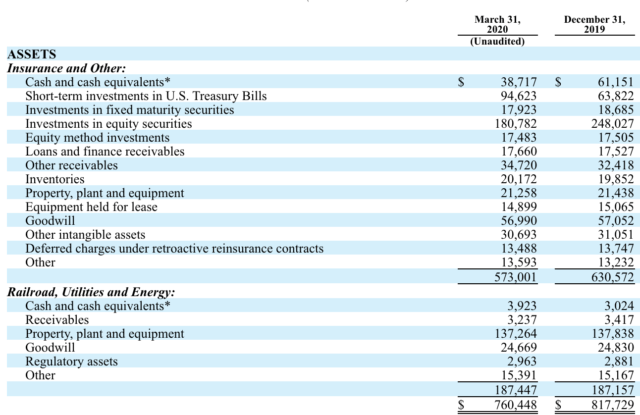

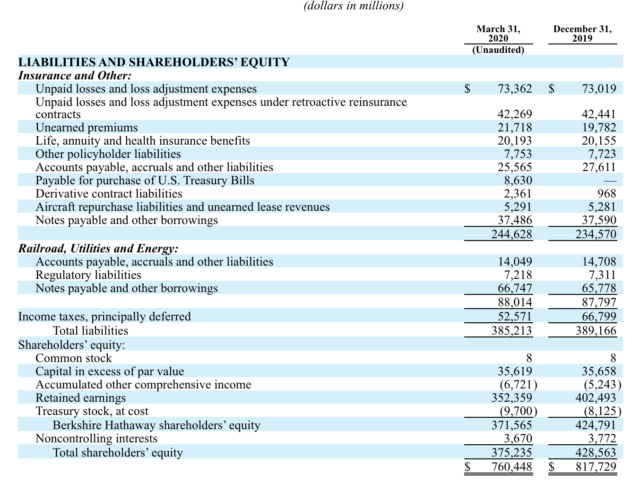

Balance Sheet

Source: 10-Q

Berkshire Hathaway’s balance sheet is broken up into two segments for both assets/liabilities: “Insurance and Other” and “Railroad, Utilities, and Energy”.

Firstly, the company has a strong cash balance, with over $40 billion available. On top of that, Berkshire has almost $100 billion in short-term investments.

Secondly, the debt/equity sits at only 0.27. Recently, we have seen some high levels of insider buying, and this could be a sign that Berkshire is ready to deploy some cash to carry out more buybacks or even increase the dividend.

We can learn two things from the balance sheet. First, the company is strong enough to weather any storm and, on top of that, it has various revenue streams that it can exploit. The strength and richness of the Balance Sheet bring me to my next point.