Summary

- CMS Hub launch is a low-risk way to drive subscriber ARPU. We expect strong attach rates going forward.

- Relaunched Enterprise Marketing Hub should also increase multi-product adoption while driving higher ACV deals.

- HubSpot has always outperformed its profitable growth expectation. Given the catalysts, it is well-positioned to continue doing so comfortably.

Overview

HubSpot's (HUBS) share price has appreciated by +48% since our first coverage on the stock last November, where we highlighted HubSpot’s transformation into an end-to-end CRM player. HubSpot has since made a further strategic decision that increases our conviction in its mission, including the launch of a CMS (Content Management System) Hub and continuing R&D investments in its Marketing Hub offering to strengthen its enterprise positioning. We continue to recommend HubSpot and maintain an overweight rating on the stock accordingly.

Catalyst

Launch of new CMS Hub is a low-risk approach to drive higher subscription ARPU (Average Revenue per User). In Q1, HubSpot saw a solid 33% revenue growth despite the pandemic. ARPU also increased by 2% YoY from $9,811 to $10,018 in Q1, as a result of new customers purchasing higher-priced plans and client-base expansion.

(source: company’s earnings call slide)

In our view, CMS Hub, which is priced at $300 at a professional plan and three times as much at the enterprise tier, appears to be a strategic way to increase the ARPU by incurring lower risk. As CEO Brian Halligan mentioned in Q1, CMS Hub pro is formerly just an add-on for the Marketing Hub. With that in mind, HubSpot was already in a better position to launch the CMS Hub as an offering than when it launched both Sales and Service Hubs. We believe that HubSpot even had the best piece of information it needed to make the launch and pricing decision, such as the activity level and use cases for its CMS add-on.

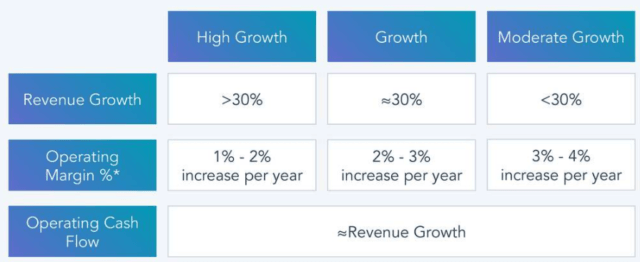

Upgrade of the Marketing Hub will provide stronger positioning in the enterprise market and help drive HubSpot's profitable growth goal. Even without the relaunch of enterprise Marketing Hub in Q1, HubSpot had always been exceeding its profitable growth expectation highlighted in its framework.

(source: company’s earnings call slide)

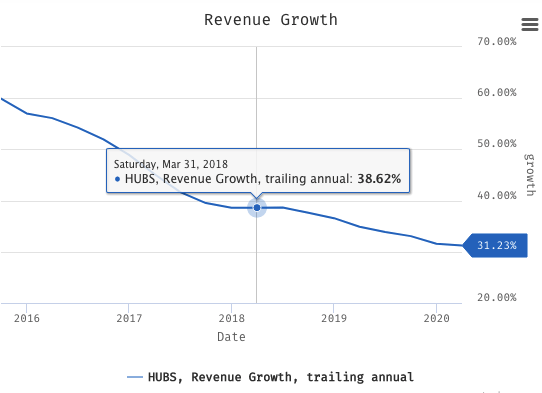

Operating margin, for instance, increased by over 600 bps (6%) in the last two years, averaging ~3% each year. At the same time, revenue growth had been much better than the expected 30%. In between 2017 to 2019, HubSpot saw TTM revenue growth between 32% and 38%.

(source: stockrow)

Consequently, we expect the enterprise Marketing Hub to continue sustaining the strong profitable growth. It can do so through increasing subscription ARPU and multi-product adoption, which has trended positively. Out of 78,000 customers in Q1, 32,000 reportedly were multi-product customers. Furthermore, HubSpot has also been strategic in incentivizing multi-product adoption. It offers a sizable 25% bundling discount for a purchase of an entire Sales, Service, and Marketing Suite. Furthermore, the new Enterprise Marketing Hub also comes with an advanced chat targeting feature that typically complements the Sales Hub offering.