Summary

- Mastercard's earnings and stock price have appreciated strongly in the last decade.

- The Mastercard-Visa duopoly is still standing strong.

- An in-depth look at the bear case against Mastercard.

- The steep entry barriers in the electronic payment industry and the global banking network of Mastercard-Visa will secure the profitable duopoly position in the future.

Mastercard (MA) probably doesn't require an elaborate introduction, as a sizeable share of Americans are using a Mastercard on a regular basis. Together with Visa (V), both companies dominate the credit card market, both in the USA and on a worldwide basis.

As more and more payments are being executed digitally, both Mastercard and Visa have seen their revenues and earnings grow materially in the past decade. The growth in earnings has been accompanied by solid profitability margins and free cash flow growth, which has attracted investors to solidly increase the market value of Mastercard.

In this article, we will have a short look at the stock price performance of MA and the underlying long-term fundamentals behind this growth story. We will then have a look at the bear case on Mastercard, by providing a summary of the bearish articles/cases on Mastercard.

Historical Performance

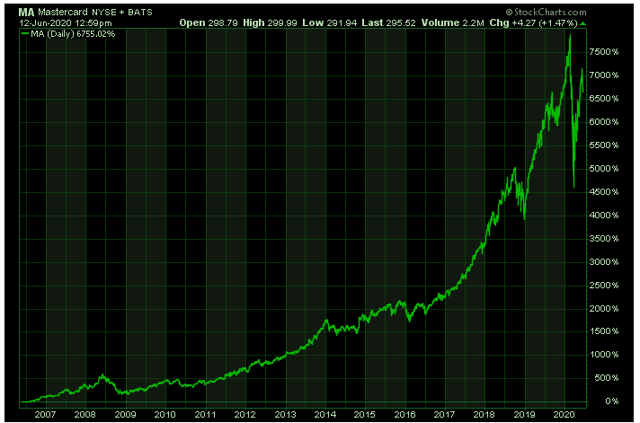

Mastercard went public on 25 May 2006, as the company issued around half its 135 million shares to the public. A total amount of $2.4 billion was collected at the offering day, bringing the total market capitalization to $5.3 billion.

Fast-forward to today (12 June 2020), the market capitalization value has grown to $280 billion. The value of the company has 53-folded its starting value of 2006. Since the inception date, shareholders of MA would even have done better than that, as they would have received numerous dividend payments and Mastercard has regularly bought back its own shares.

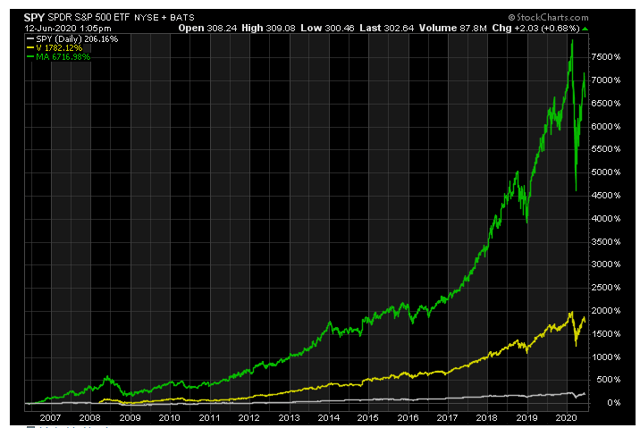

Source: stockcharts.com

The stock price has significantly outperformed the general stock market (SPY) over this period. The uptrend has materialized year after year, only halted by temporary stock price corrections.

One share of Mastercard currently costs $296, bringing the total market value to $280 billion. This makes Mastercard the sixteenth-largest company by market cap, whereas Visa is currently the tenth-largest company.

At the right end of the chart, you can see a more severe decline in stock price. This is the impact of the recent Coronavirus correction, which pulled the stocks from all sectors and industries down as global consumption declined as a consequence of the lockdown measures. The stock price declined strongly but soon recovered in a V-style pattern, retracing its previously high levels.