Summary

- Bristol-Myers Squibb is a high quality player in pharmaceuticals.

- The company has an outstanding track record of consistent revenue growth and superior profitability.

- The Celgene acquisition makes sense from a financial and strategic perspective.

- The stock is very reasonably valued at current levels.

- The risk and reward trade-off in Bristol-Myers Squibb looks clearly attractive going forward.

- I do much more than just articles at The Data Driven Investor: Members get access to model portfolios, regular updates, a chat room, and more. Get started today »

Smart investing doesn't need to be too complex or sophisticated. On the contrary, a simple and straightforward idea can many times produce superior returns. Bristol-Myers Squibb (BMY) is a top-quality company in pharmaceuticals, the fundamentals are solid, and the stock is attractively priced at current levels. This can be an effective combination for market-beating returns in the years ahead.

A High-Quality Business

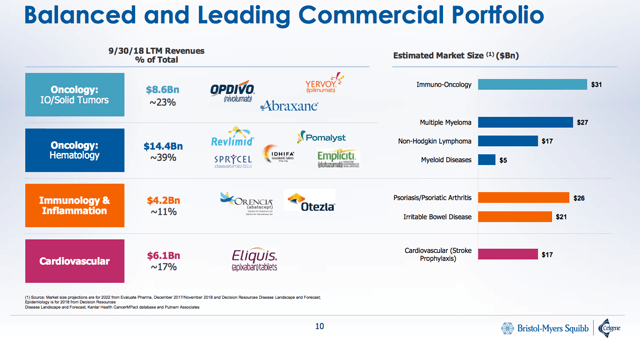

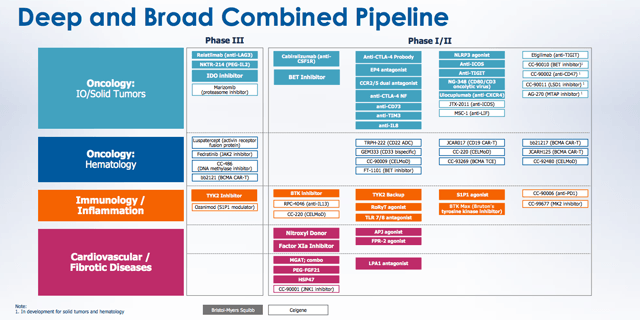

Through internal developments, partnerships, and acquisitions, Bristol-Myers Squibb has built a strong portfolio of drugs and a deep pipeline of products with promising potential in the years ahead.

Patent protection provides pricing power and profitability, and big cash flow generation generates the resources for massive investments in research and development for further growth. The size of the business provides a key layer of competitive strength in the industry, as a big player such as Bristol-Myers Squibb benefits from scale advantages, distribution capabilities, and a global salesforce that smaller competitors cannot match.

The recent acquisition of Celgene is not without risk, but the move makes sense from a financial and strategic perspective. Management estimates that the acquisition will be accretive to earnings per share by 40%, and run-rate cost synergies from the acquisition are expected to be $2.5 billion over three years.

Size and diversification provide competitive strengths while also reducing drug-specific risk. Besides, the integrated company has plenty of opportunities for growth, both when looking at the current portfolio and the development pipeline. Management is working on 8 launches over the next 24 months; if the company can in fact deliver, this could be a powerful driver for the stock price.

Source: Bristol-Myers Squibb Source: Bristol-Myers Squibb

Source: Bristol-Myers Squibb

Even before the Celgene acquisition, Bristol-Myers Squibb has proven its ability to produce industry-leading performance over the long term.

The chart below shows revenue growth rates for Bristol-Myers Squibb versus other big industry players like Johnson & Johnson (JNJ), Novartis (NVS), Pfizer (PFE) and Merck (MRK). The company has outgrown its peers by a considerable margin over the past five years.