Summary

- Ribbon Communications has recently seen a 20% downside following misses in revenue and earnings.

- Q3 earnings release also shows that other metrics, namely gross and net margins have improved and that management is delivering on its software-driven strategy.

- Other metrics like clarity of vision, competitor's weakness, and diversification all mean strength.

- The recent downside in stock price together with the low valuation has opened a window of opportunity for investors.

Editor's note: Seeking Alpha is proud to welcome Chetan Woodun as a new contributor. It's easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA PREMIUM. Click here to find out more »

Ribbon Communications (RBBN), a technology and services provider, has just raised the fears of its investors with its third quarter results after the company reported revenue and earnings misses. Full-year outlook is also on the lower side. The company's shares slid by more than 20% on the news. This drop aroused my interest and motivated me to proceed with further analysis of the Q3 earnings release for metrics other than revenue and earnings.

Figure 1: RBBN share price slide

Source: Ycharts

I started with gross profit margin (gross margins) and operating margin (net margins) as despite falling revenues and earnings, it is still possible for a company to mint money through structural and cost-cutting changes, thereby enriching their shareholders.

Improved margins

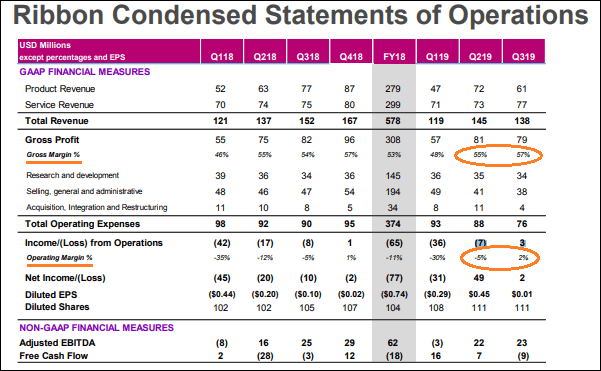

Gross margins have increased from 55% to 57% from the second quarter to third quarter 2019. Also, net margins have improved significantly from -5% to +2%. These are highlighted in Ribbon's condensed statement of operations:

Figure 2: Ribbon Statement of Operations

Source: Ribbon Q3 earnings release.

What does this mean? The fact that both profitability metrics have improved means that the current financial condition, as well as prospects for future profitability, is good. And the fact that these have been achieved despite falling revenues means that there have been cost reduction measures as well.

As per CFO Daryl Raiford in the earnings call transcript:

Turning to profitability, we were pleased with our progress toward our longer-term goals for adjusted EBITDA margin. The third quarter saw us achieve a record gross margin level since the launch of Ribbon in 2017. This result coupled with our improved cost structure enabled us to deliver an adjusted EBITDA margin of 17% ahead of our expectations and on par with our seasonally high fourth quarter of last year."

At this point, it was evident that based on profitability metrics, an investment in the company was starting to make sense. The next step was to consider the effectiveness of the management. Not only it is important for a company's management to formulate strategies to succeed but also "strategy without execution is meaningless".