Summary

- Frontier Communications issued disappointing guidance once again.

- The company continues to experience financial and operational deterioration and its management has yet to take control of things.

- Risk-averse investors should avoid the company altogether.

It seems like problems for Frontier Communications (FTR) and its shareholders just won't end. The telecom company posted yet another set of disappointing results earlier this month. The stock is down by about 30% over the past three weeks alone, but the downtrend may not be over yet. Given the telecom stalwart’s continued subscriber base erosion, lowering of EBITDA guidance once again and its ongoing revenue deterioration, I continue to believe that its shares could still head lower. Let’s take a closer look at it all.

(Source: Bigstockphoto, Image license purchased by author)

Financial Deterioration

Let’s start by going over Frontier’s headline numbers first. Its Q2 revenue and adjusted EBITDA figures came in at $2.07 billion and $882 million respectively. These were more or less in-line with prior expectations– the Street’s forecasts and management’s guidance -- so there aren’t any red flags here. The company also incurred a goodwill impairment charge of $5.45 billion during the quarter but I had already warned investors in my last article, noting that something like this would happen in its Q2 earnings report.

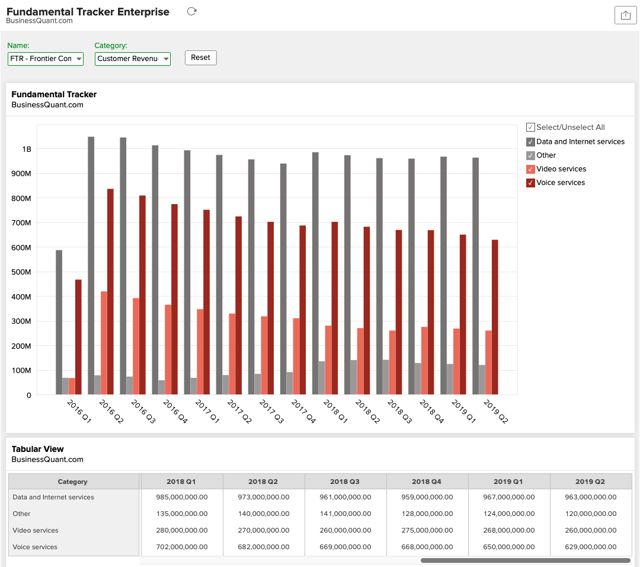

The chart above highlights that its customer revenue continued to decline in Q2 across all services. A larger issue comes to light when we talk about guidance. The company’s management lowered their target for their ambitious cost savings program. They were initially forecasting $500 million in annualized adjusted EBITDA run-rate savings by 2020-end, but they reduced it to between $200 million and $250 million, citing operational difficulties and complexities. Daniel McCarthy of Frontier addressed this during the Q2 earnings call:

While we are ahead of plan in achieving the cost reduction targets of the transformation program, we anticipate greater challenges in achieving improvements in revenue and customer trends.

The impact?

Its management lowered its full year adjusted EBITDA guidance once again and they’re now forecasting the figure to come in between $3.35 billion and $3.42 billion, amounting to a mid-point guidance figure of $3.385 billion. I’ve updated my adjusted EBITDA tracker for Frontier in the table below.