Summary

- Berkshire Hathaway is an extremely complex corporation to value.

- Berkshire Hathaway is expensive at current market price.

- The price that you pay is very important in any investment decision.

Berkshire Hathaway (BRK.A, BRK.B) is one of the most famous and respected companies in the world. A lot of books, articles and commentaries have been written about it. Nevertheless, it is so hard to value and calculate its intrinsic value that it is better to put your money in some other stock.

Past

Average annual return on Berkshire Hathaway shares since 1965 is 20+%. As a result some investors multiplied their capital many thousands of times.

But if you look for the last 10, 5 or less years Berkshire Hathaway returns more or less mimic the S&P 500 performance.

This is probably OK for most investors. Anyway, most of us will never beat the market and buying share of Berkshire is a convenient way to invest your hard-earned money. Of course, there are a lot of companies with better than Berkshire Hathaway performance in the last years but in most cases this is obvious only in hindsight.

What troubles me as an investor is a tremendous complexity of Berkshire Hathaway and my absolute inability to find any yardstick to value it against.

Value

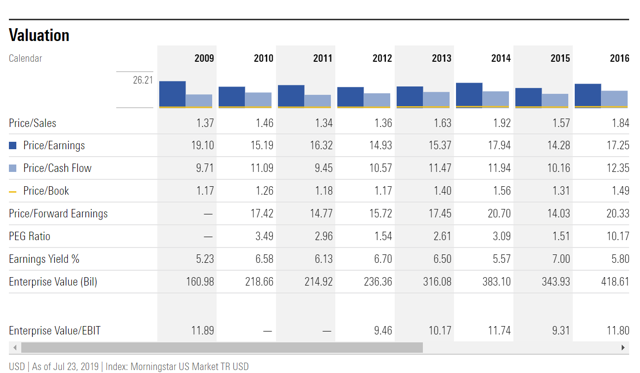

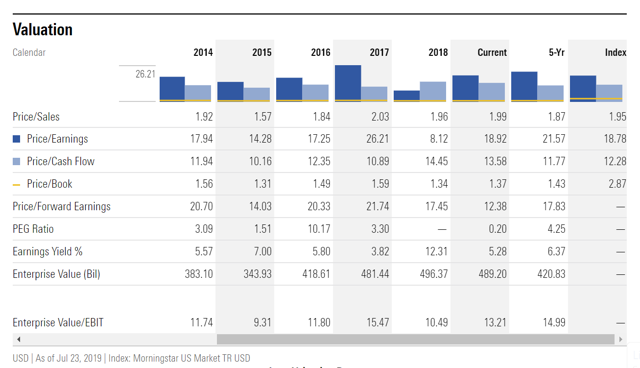

For more than 50 years Buffett himself measured progress of Berkshire Hathaway by percentage change in per-share book value. It was pretty straightforward and easy to understand. Nonetheless, share price over the years increased much faster than book value per share. I think this is related with Buffett's "campaign" which began many years ago when he started emphasizing that intrinsic value of Berkshire is much bigger than book value. In most years Berkshire shares traded above book value:

This year in his traditional annual letter Buffett decided to abandon past practice. He declared that book value now is not as relevant measure of Berkshire success as in the past. He decided to focus just on Berkshire market price. This is very troubling to me.

Don't get me wrong - I admire Mr. Buffett and have deep respect for him and his long term business partner - Charles Munger. They taught me so much about business, investing and life in general. They deserved their reputations and their ideas should be taught in every school throughout the world.

At the same time I do not understand how to value Berkshire Hathaway. Let's try to do it together.