Summary

- Frontier Communications will be hosting its Q2 earnings on August 6, but it won't be hosting a question and answers session this time around.

- The fact that its management isn't taking the opportunity to clear the air and get rid of unwarranted speculation is rather worrisome.

- The lack of a Q&A, at a time when investors are debating the company's future, would only fuel speculation and make its shares even more volatile.

- Frontier Communications is uninvestable, and investors should avoid the stock altogether.

Frontier Communications (FTR) issued a press release earlier this month, noting that its Q2 earnings report is scheduled for release on August 6. But there's one detail in that press release that raises concerns. It's that management will be presenting their prepared remarks, but they won't be hosting a question and answer session. The company has been hosting a Q&A session during its earnings call for several quarters now, and the absence of it, while the company is wading through rough waters, is only going to fuel speculation and make the scrip riskier and more volatile.

(Source: Bigstockphoto, Image license purchased by author)

Hints of Negative News

Let me start by saying that nobody except for Frontier's HQ and associated personnel probably knows for sure why its management isn't hosting a question and answer session. This is a crucial time for the company and its shareholders, where its future is being evaluated and investors are debating whether or not the company would preemptively file for bankruptcy protection. So, Frontier's upcoming earnings call would have been an opportune time for management to extinguish baseless speculation pertaining to its future.

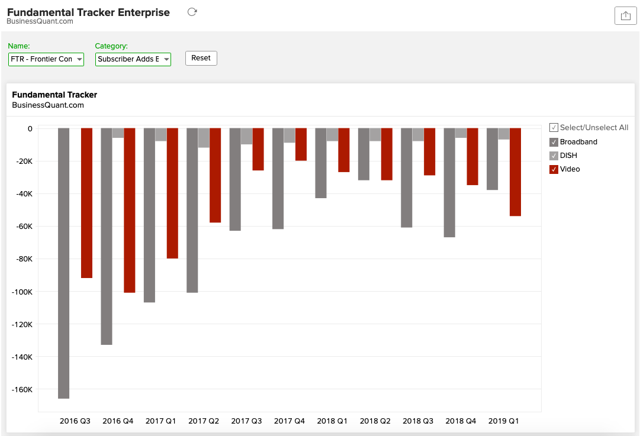

Not only that, Frontier communications has been posting dismal operating numbers, and a Q&A session would have allowed analysts to ask critical questions to get a realistic update on how exactly its core business is coming along. But since the Q&A session isn't happening now, it may fuel unnecessary speculation and baseless conjecture amongst both short-side traders and long-side investors. Neither of the sides would have enough dots to connect, which may make the stock highly volatile over the coming weeks.

I had discussed in an earnings preview article on the company, published earlier this month, the key items that investors should be focusing on in Frontier's upcoming earnings call to determine the state of its turnaround. But investors would now have to suffice with the management's prepared remarks, and there would be limited room to seek answers to some of the discussed critical questions. I believe that the added uncertainty would only make Frontier Communications uninvestable for risk-averse investors.

If Frontier's management had anything positive to say, something that would present the company in a good light and fuel its turnaround story, then I don't think its management would have skipped any chances to share new developments or its progress with the shareholders. That would have pushed its share price higher and relaxed its board members a bit. But the fact that its management is choosing to skip that chance is alarming from the standpoint of long-side investors, especially when the company's future is in question.

Readers, investors, market commenters, and analysts would now get a chance to ask relevant questions only during the subsequent Q3 earnings call, that is, if the company's management decides to host a Q&A session eventually. That's a little over 3 months away. In the meantime, investors would have to fend for themselves and invest based on assumptions, rumors, speculation, and conjecture. This boosts the risk profile for Frontier Communications and makes the reward portion of the investment unknown, making it more of a gamble.