Summary

- Thermo Fisher Scientific is a high-growth industrial that brings cutting-edge solutions to the industrial, pharma, and analytical fields.

- The company's aggressive M&A has paid off, and the operational metrics of the company are trending upward.

- The stock is modestly overvalued, but not too far off from an attractive entry point for long-term investors.

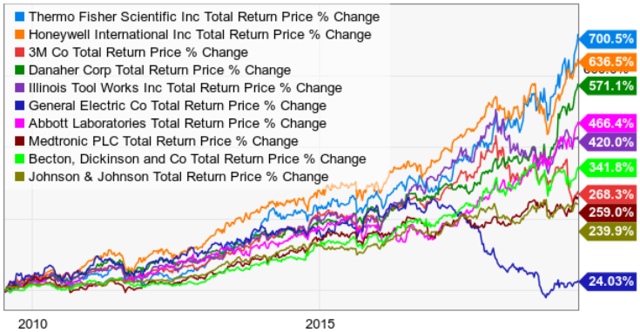

Whether you are already aware or not, high-tech industrial, analytical and laboratory equipment maker Thermo Fisher Scientific (TMO) has been an extraordinary investment over the past decade. To define extraordinary, investors have realized annual returns exceeding 20% per annum throughout the decade. A $10,000 investment made 10 years ago would be worth more than $75,000 today. In fact, the company has outperformed just about every peer of its size and market type.

(Source: YCharts)

So, what has been the driver of Thermo Fisher's success over this time frame? The company has vastly improved its core operating metrics. In addition, management has done well positioning the company in markets that will be part of solving large scale solutions in the years to come. These growth opportunities have driven strong top and bottom line growth that continues to propel Thermo Fisher's intrinsic value higher each year. We look at this, and why investors should have Thermo Fisher Scientific on their watch list for when the stock market eventually offers a better buying opportunity.

Performance Overview

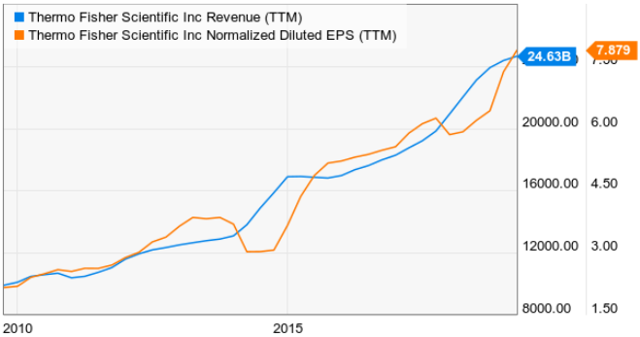

(Source: YCharts)

Thermo Fisher Scientific has experienced immense growth throughout the decade. This has been driven both by organic growth and an aggressive acquisition strategy (more on that later). Over the past 10 years, revenues have grown at a CAGR of 8.78% and EPS at a CAGR of 12.20%.

We will look at the underlying operating metrics of Thermo Fisher Scientific to gain a better of understanding of the company's stretch of success.

We review operating margins to make sure the company is consistently profitable. We also want to invest in companies with strong cash flow streams, so we look at the conversion rate of revenue to free cash flow. Lastly, we want to see that management is effectively deploying Lincoln Electric's financial resources, so we review the cash rate of return on invested capital (CROCI). We will do all of these using three benchmarks:

- Operating Margin - Consistent/expanding margins over time

- FCF Conversion - Convert at least 10% of sales into FCF

- CROCI - Generate at least 11-12% rate of return on invested capital

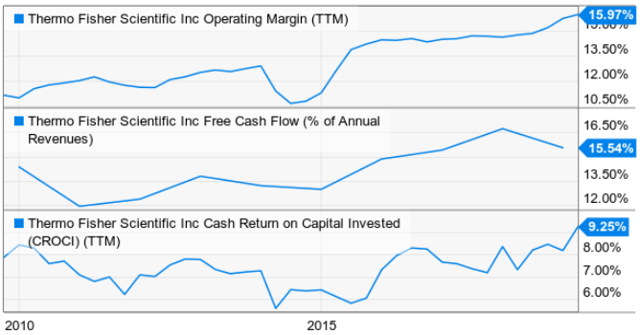

(Source: YCharts)

A clear ingredient to Thermo Fisher's success has been the company's ability to become drastically more profitable. Operating margin has improved notably, as has the company's conversion rate of turning sales dollars into free cash flow. This, combined with high-single digit revenue growth, has led to annual free cash flow streams that exceed $4 billion (over the trailing 12-month period). We would like to see a higher cash rate of return on invested capital (CROCI), but this can take a hit when a company utilizes heavy M&A (and the metric has clearly trended upward since bottoming four years ago).