Summary

- Kalydeco, Orkambi, and Symdeko continue to report robust demand trends in CF population.

- FDA approval for Vertex's triplet regimen can dramatically expand its addressable CF market.

- The company is exploring opportunities in other promising therapeutic areas.

- Investors cannot ignore certain company-specific risks.

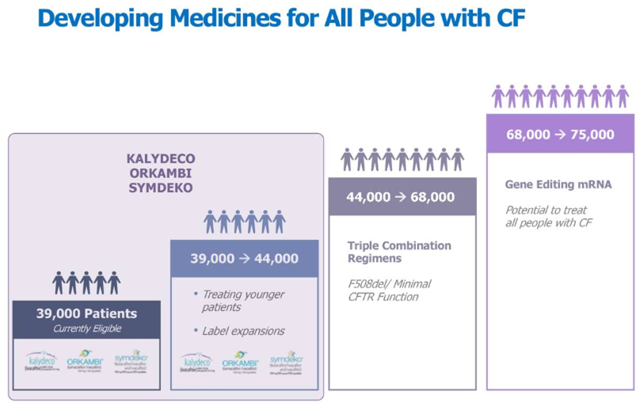

Vertex Pharmaceuticals (VRTX) today stands as the undisputed leader in CF (cystic fibrosis) segment. The drug is treating 18,000 patients. The company is targeting total addressable patient pool of 44,000 or 50% of the total CF patients, with its three commercialized drugs, Kalydeco, Orkambi, and Symdeko, based on all of their approved labels. The company, however, is not satisfied and is working towards expanding its addressable market to 90% of the CF patients or around 68,000 patients with its investigational triplet regimens.

Besides this, the company is also pursuing opportunities in other therapeutic areas such as pain, alpha-1 antitrypsin deficiency, sickle cell disease, beta-thalassemia, and focal segmental glomerulosclerosis, either organically or inorganically.

I believe the high growth phase will continue for Vertex Pharmaceuticals, as it gets ready to seize opportunities in new indications and markets. In this article, I will explain why I consider Vertex Pharmaceuticals to be an attractive investment opportunity in 2019.

Kalydeco, Orkambi, and Symdeko continue to be high-growth assets for Vertex Pharmaceuticals.

The consistent focus on developing and launching innovative CF products has proved to be highly remunerative for Vertex Pharmaceuticals. The company has been reporting YoY (year-over-year) double-digit revenue growth since the first quarter of 2016. In the first quarter of 2019, the company's revenues rose by 34.34% YoY to $858 million. In its first-quarter earnings call, Vertex Pharmaceuticals has guided for revenues of $3.45-3.55 billion in fiscal 2019, a YoY rise of 15.13% at the midpoint.

Kalydeco and Orkambi continue to witness rapid adoption in their targeted CF patient population, driven by fast-improving access and regulatory approvals that allow for the use of these drugs in younger patients across the world. Although both drugs reported YoY (year-over-year) revenue decline in the first quarter, it is not a matter of worry considering that this drop was due to higher gross-to-net adjustments and channel inventory buildup in late 2018. The extra inventory has been used up in the first quarter, thereby making this problem only temporary in nature. The higher gross-to-net adjustments were due to increased buying from 340B entities and increased spending of the company on its cost-sharing program, which again is not a systemic problem.

In the first quarter, Vertex Pharmaceuticals reached several pricing and reimbursement milestones for Kalydeco and Orkambi in multiple ex-U.S. markets such as Germany, Sweden, and Israel. The company is also leveraging its huge body of clinical data to negotiate with payers across the world.

In France, the company has already initiated 1,100 of the 1,700 eligible patients on Orkambi through early access program. While the company is being reimbursed for its products, Vertex plans to recognize revenue only after final reimbursement agreement is secured. Securing reimbursement in France has proved challenging, and a favorable outcome will have a solid impact on the company's growth rate in 2019.

Besides the two older drugs, the recent FDA approval of Symdeko (tezacaftor/ivacaftor and ivacaftor) and subsequent U.S. market launch has proved to be a solid growth driver for Vertex. Originally approved for people aged 12 years and older who have two copies of the F508del mutation or one mutation that is responsive to SYMDEKO, FDA has recently approved the drug for children aged 6 to 11 years. While ex-U.S. markets will be mostly driving revenue growth for Symdeko henceforth, the new FDA approval will definitely have a positive impact on patient uptake in the U.S.

Symdeko garnered $320 million revenues in the first quarter, a dramatic rise of 841% on YoY basis. The drug earned $32 million from Germany where it is launched under the brand name, Symkevi. Patients who never used Orkambi or who have discontinued or switched from Orkambi have been preferring Symkevi in Germany. Symdeko has received a positive recommendation from the Pharmaceutical Benefits Advisory Committee, an important milestone for securing reimbursement in patients aged 12 and older.