Summary

- Torchmark is rather "unknown" but has a long history of very profitable underwriting and outperformance of the markets.

- Berkshire owns 5.8%, and insiders, 3.6%.

- Very wise capital allocation via buybacks and much less focus on the tax-inefficient dividend.

- Because the investment portfolio is mainly corporate debt, the stock fluctuates quite a bit, and this offers opportunities to purchase shares and increase annual returns.

Summary:

Torchmark (NYSE:TMK) is one of the more unknown companies that hardly gets any coverage. Still, it performs very well year after year and has quietly beaten the averages. Furthermore, Berkshire Hathaway (NYSE:BRK.B) owns 5.8%, and insiders 3.5%, and in this article, I try to understand why they own it.

Torchmark has a very profitable underwriting business and, at the same time, high interest income from the float. As a result, the stock has compounded at 14% since 1990. In addition to strong operational performance, management has allocated capital wisely. Because of this, and several other reasons, I expect the stock to perform better than the market over the next decade(s).

Reason Number 1: The Business Model - Low Costs And High Retention Rate

Insurance is a highly competitive business where the industry as a whole usually makes a loss on their underwriting, just so they can get a slice of the valuable float. Because insurance companies are paid premiums up front, underwriting operations provide a “costless”, sustained source of investable cash called float.

Torchmark has a rather ”simple” and easy to understand business model and has been selling the same products for over 50 years: life insurance (about 70% of revenue) and health insurance. Life insurance is a contract between the insurer and the insured, where the insured agrees to pay for the policy on a regular basis (or a lump sum), and the insurer agrees to pay a certain sum of money if you die or get ill (to the beneficiaries). The insurer, of course, hopes to receive more in premiums than it pays in claims. Sometimes, the policies lapse, most often because the insured simply stops paying for whatever reason, leaving the insurer with the premiums already paid as profits.

Because the insurance business is competitive and has a commodity-like pricing, Torchmark has targeted middle and low income families (and union members), a niche they have had for a long time. Most people in these groups often have no insurance or presumably little insurance, a market that Torchmark believes is underserved and where competition is limited. So far, this strategy has paid off really well, and I believe they have a narrow moat around this business.

Torchmark has a competitive advantage in their low expenses. This allows for competitive rates while, at the same time, margins are more than acceptable. General expenses have been around 7% of premiums received, and this is substantially less compared to peers (MetLife (MET) has, for example, more than the double). One of the reasons for this is a low lapse ratio. Obviously, it costs less to renew a policy than to reach a new customer.

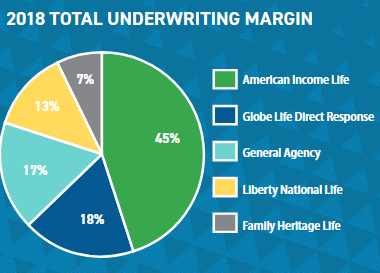

Torchmark serves as an umbrella for five different companies/distribution channels:

Source: Annual report 2018

Source: Annual report 2018