Summary

- Bristol-Myers Squibb announced its plan to acquire Celgene more than 6 months ago. The deal has since been approved by shareholders from both companies.

- Celgene has maintained its EPS guidance for the year, while Bristol-Myers Squibb has increased its guidance. Both companies are continuing to execute wonderfully.

- The combined company will still have patent cliffs. However, the drugs facing patent cliffs are expected to continue growing over the next several years.

- The combined company will be a cash flow machine, generating almost half of its market cap in cash flow over the next 3 years, with a manageable debt load.

- I am more heavily invested in Celgene than Bristol-Myers Squibb. However, I look forward to reading your opinions below.

- Looking for more? I update all of my investing ideas and strategies to members of The Energy Forum. Start your free trial today »

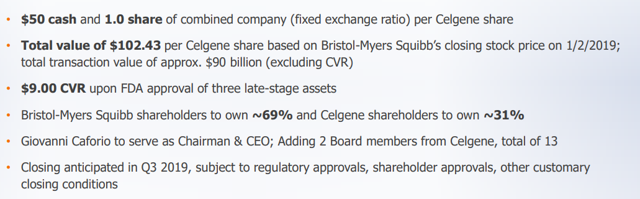

At the start of the year, 2019, Bristol-Myers Squibb (NYSE:BMY) announced it was planning to acquire Celgene (NASDAQ:CELG). The announcement was unexpected, leading to a massive run-up in Celgene’s stock price. The details have yet to be ironed out. However, current estimates show that it will likely be the third largest healthcare acquisition ever. I originally analyzed the deal here, which I recommend reading. This article will help provide investors with an update and how the companies are on the path to a valuable combination.

Company Combination - Announcement Investor Presentation

Celgene and Bristol-Myers Squibb Acquisition

Before we delve down into the updates since the announcement of the transaction, let’s start by discussing the details of the transaction. It’s important to note that on April 12, shareholders of Bristol-Myers Squibb votedin favor of the transaction, so at this point, it will almost certainly be going through in 3Q 2019, as originally planned.

Deal Terms - Announcement Investor Presentation