Summary

- Key insiders have been buying the stock for a reason. They're a bargain. Critically, they constitute, not mere value, but also a bet on growth investment status recapture.

- A key setback to BIIB's AD pipeline and maturation of MS franchise, coupled with emerging competitive, have put tremendous pressure on the stock.

- But the company's financials remain healthy. Share price collapse may provide investors with a buy opportunity.

- A reequilibrium of revenue generation engines (a challenged MS but growing SMA and biosimilar franchises), and efforts at diversifying all-stage pipeline assets, are promising, starting to impact.

- Major pipeline wins or a synergistic acquisition may catalyze BIIB. A third path is BIIB being targeted itself, but it'd be a short-term boost with possible loss of compounding effects.

Let's spell Biogen Buy-o-Gen. Indeed, BIIB seems increasingly appealing at current price.

The biotech focuses on discovering, developing, and delivering therapies to people living with serious neurological, rare and autoimmune diseases. The Company markets various products for multiple sclerosis (MS), SPINRAZA for the treatment of spinal muscular atrophy (SMA), and a number of biosimilars. BIIB has a range of other products and drug candidates in various stages of development.

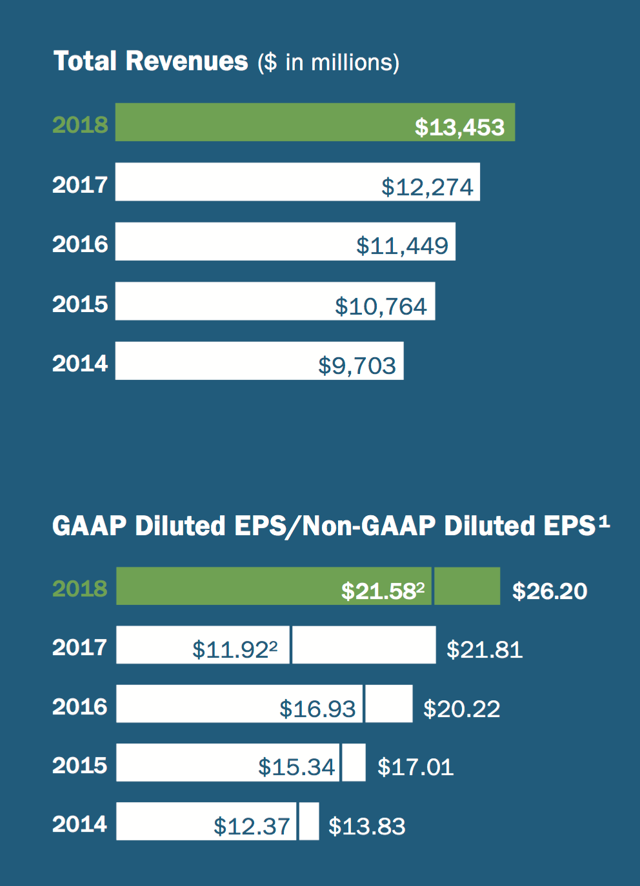

Financial Performance Remains Strong

First, some financial metrics are in order. Let's get grounded. Sentiment is volatile, numbers-based performance is not...

Source: 2018 Annual Report, BIIB

Source: 2018 Annual Report, BIIB