Summary

- Biogen has yet to recover after discontinuing its drug study for Alzheimer's disease.

- Compelling valuations.

- Share buyback and product pipeline are just a few positive catalysts.

- This idea was discussed in more depth with members of my private investing community, DIY Value Investing. Start your free trial today »

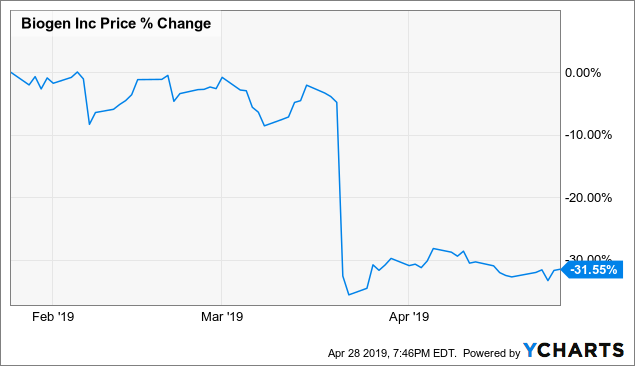

When Biogen (BIIB) discontinued phase 3 trials of aducanumab, a monoclonal antibody Alzheimer's disease, the stock plunged around 30%. Even its first-quarter earnings report, which included a massive share buyback announcement, failed to move the stock. Does Biogen deserve to stay in the doghouse or should investors seeking value start a position in the beaten-down stock?

Data by YCharts

Data by YCharts