TJX (TJX) is similar to Ross Stores (ROST), in that it provides a treasure hunt-like atmosphere that lures in bargain-conscious shoppers who would otherwise probably just head straight over to Amazon (AMZN). Will this insulate it from Amazon forever? I'm not sure, but it likely at least makes it more resistant than many other retailers that sell things like basic consumer electronics or books.

Return on invested capital analysis

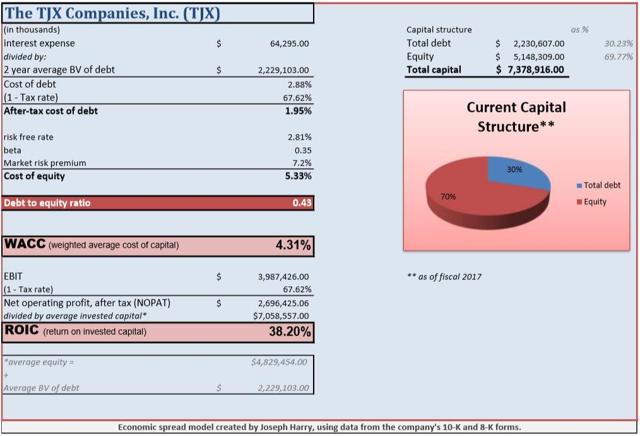

TJX earns very high 'headline" ROIC with a healthy balance sheet.

Like pretty much every retailer, including Ross, it also utilizes a large amount of "off-balance sheet" financing in the form of operating leases, however. These leases are long-term and noncancelable in nature, and if we choose to theoretically capitalize them, we can calculate estimates for an operating lease-adjusted debt-to-equity ratio and ROIC.

Like pretty much every retailer, including Ross, it also utilizes a large amount of "off-balance sheet" financing in the form of operating leases, however. These leases are long-term and noncancelable in nature, and if we choose to theoretically capitalize them, we can calculate estimates for an operating lease-adjusted debt-to-equity ratio and ROIC.