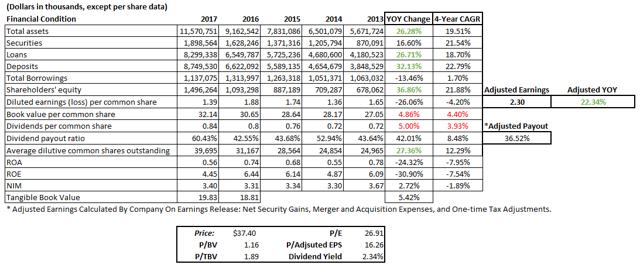

After looking into some smaller banks in Massachusetts, I thought I’d check-in on a larger peer that was growing through expansion. For this, we turn to Berkshire Hills Bancorp (BHLB), an $11.5 billion asset bank that passed the $10 billion (higher regulatory threshold) mark after its purchase of Commerce Bancshares closed in October (2017).

Sourced from 10-K

As you can see from above, YOY earnings fell 26% due to several one-time items (net security gains, merger and acquisition charges, and one-time tax adjustments), which compares to adjusted earnings growth of 22.3%. This is an acquisitive bank and I like that the new purchase helped add some much-needed deposits (loan to deposit ratio from 108% in 2013 to 94% in 2017) that can be used to either grow loans or lower the balance of more expensive other borrowings (total borrowings fell 13.6% YOY).